Labour welfare in PressForm Industries

Every organization hears what employees say, good organization listen to what employees have to say but organization with employees welfare scheme listen what employees don’t say

- Labor welfare is a comprehensive term including various services, benefits, facilities which is provided over and above the wages to the workers by employers.

- It is provided by the government, trade union & non government agencies in addition to the employers.

In the following our labor welfare facilities are showcased.

Recruitment Policy:

Newly appointment staff/worker are to submit their Proof of Date of Birth, ID proof, address Proof . We never engage below 18 years.

Medical facilities

Medical care and health facilities are devised, not only to provide protection against sickness, but also to ensure availability of a physically fit and stable manpower for economic development. In our company we provide strong support for the medical appliance including Maternity benefit of about Rs.10,000 during the maternity period of the employee and employee wife, Any death of employee during the work hours we shall provide a sum of Rs.10,000 to the legal dependents of the employee immediately.

Canteen

The canteen is administered by the human resource department and foods are supplied at very Concessional rates.

Educational facilities

Without a good foundation of general education, the training of the workers will be both difficult and expensive. Therefore, employers have a responsibility to provide proper educational facilities to the worker stand their children. In order to have the better performance from the children, scholarships is availed from the Employer’s trust and financial grants are sanctioned. All the employees are covered under the Educational Allowances.

Canteen

The canteen is administered by the human resource department and foods are supplied at very Confessional rates.

Educational facilities

Without a good foundation of general education, the training of the workers will be both difficult and expensive. Therefore, employers have a responsibility to provide proper educational facilities to the worker stand their children. In order to have the better performance from the children, scholarships is availed from the Employer’s trust and financial grants are sanctioned. All the employees are covered under the Educational Allowances.

Insurance schemes

All the regular employees of the company are covered by the family benefit insurance schemes and group insurance schemes. The insured amount along with accrued bonuses will be paid to the workers on completion of services.

- All the employees are covered under Personal Accident Policy

- For Employees earning more than 15,000 are covered under Mediclaim Policy

- For Employees earning less than 15,000 are covered under ESI Policy

Gratuity

As per the provision of the Gratuity Act, Ow Company is paying gratuity to the workers at the rate of 15 days wages for every completed year of service based on the rates of wages last drawn by the workers concerned. (Only to employees working for more than 5 years)

Provident fund

PF is the important social security measures which can take care of the worker aher retirement. The manufactwing sector is also contributing it matching share. These amounts are paid to the workers at the time of their resignation or to the nominees in case of death. Workers could avail loan ñom their PF accounts.

Bonus

Bonus is paid at the month of September-October. Bonus will be given to the employees minimum 8.33% or Maximum of 15% as decided by the management.

For Employees who do not avail a single leave the whole month will be provided with 10% as bonus from the basic pay. The Operators who has not avail a single leave the whole year is given with the bonus of1 month salary.

At the time of AyuthaPooja based on the profit every employee will be given a percentage of bonus for sye.

Health Safety and Welfare Provisions

As per the Factories Act 1948 all the health, safety and welfare provisions are followed. Since we are manufacturing company we insist special significance on safety provision and we provide special training on General training on safety dwing their orientation session and insist employees to wear safety gadgets regularly without fail.

Child Labour

All the employees are verified with their Id Proof along with their background infomation to ensure that no child labours are appointed.

Other Allowances

- Every Employee is Provided with a three sets of uniform and safety shoe at the start of every year for free.

- All the Operators are given with a detergent soap and a bathing soap every month for free

- Overtime is given two times the pay for every hour

- During Summer time the employees are provided with Butter milk and juice and in winter season tea is provided twice a day and for night shift biscuits are provided at their break time

- Every week end snacks are provided to all the employees.

- Mobile Allowances are provided to particular Employees.

- Year end Celebrations at the month of March with Employees Family.

- Tour and travels are arranged for the employees yearly once.

- Salary Advances are provided with due dates for returns.

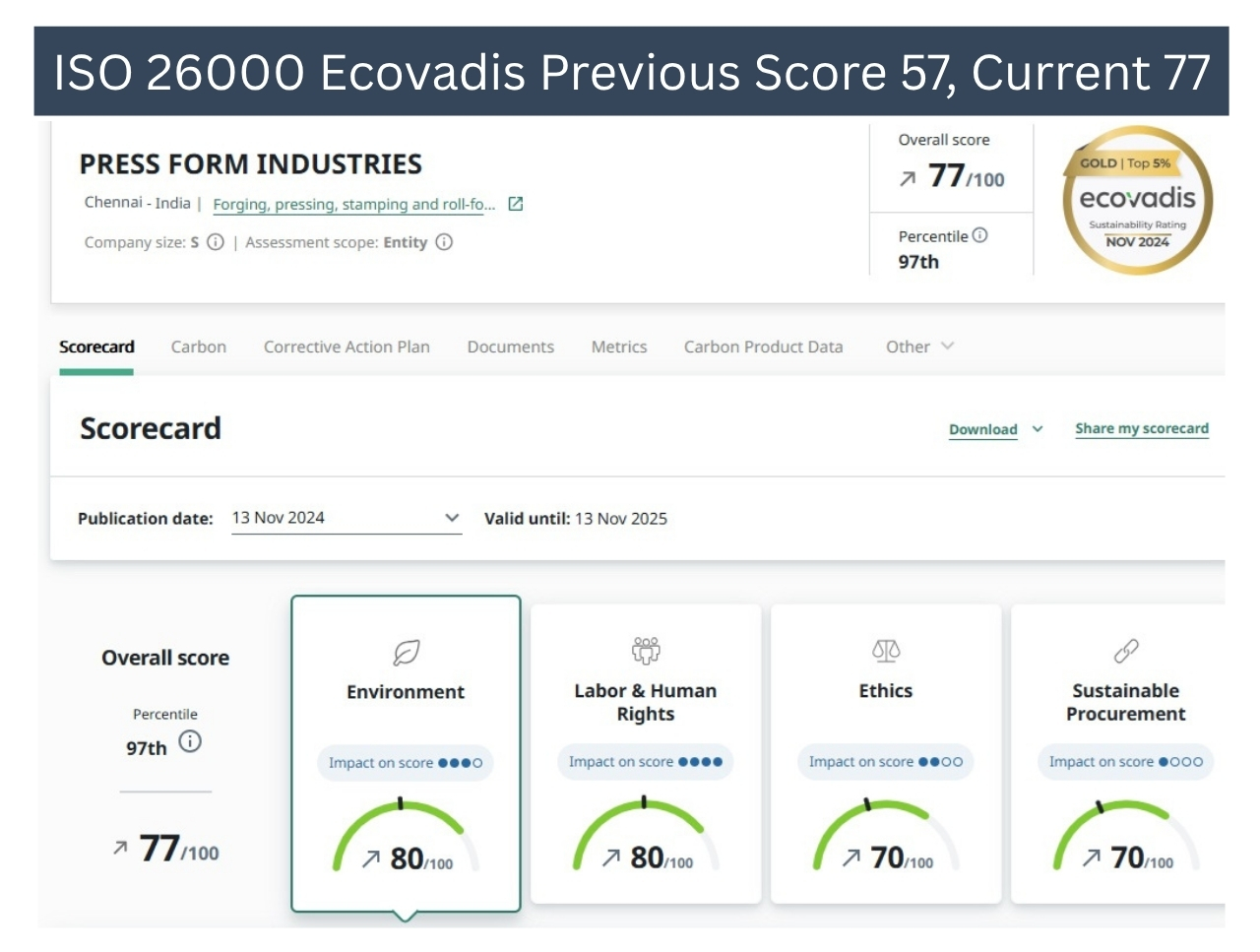

Sustainability

We are working for sustainability and a member of United Nations Global compact.We have a commitment to reduce carbon emission by morethan 50% by 2025.

Roof top solar installed

| Base Year – 2019-20 | 2022-23 | Most Recent year 2024-25 | |

| Scope 1 emission in Tons | 19.48 | 6.58 | 13.55 |

| Scope 2 emission in Tons | 382 | 286 | 274 |

| GHG Intensity(per unit of revenue)% of reduction | 48.70% | 59.90% |